Managing Amazon and other digital retail marketplace advertising campaigns isn’t a set-it-and-forget-it endeavor. As more retailers are seeing success across retail digital marketplaces such as Instacart and Target, an advertising recommendation engine is becoming a non-negotiable tool to help optimization practitioners prioritize strategic and tactical changes to accomplish their goals.

Advertising is Expensive, Automations Help Spend Your Money Smarter

Let’s first look at where we are at right now with Amazon ads buying. Think of this as the first inning of a baseball game in the overall retail-media optimization game. We see a few converging factors all happening right now that lead to retail-media advertising practitioners needing to accomplish significantly more optimization to hit their stated marketing campaign goals. These industry changes include: rising cost-per-click (CPC) bid costs, rising inventory costs, rising shipping costs, and increased competition of bidding on the same keywords.

This evolution of rising media costs in a new biddable media marketplace channel, and the need for additional optimization as a result, isn’t a new phenomenon. Other historic or “traditional” biddable media channels, such as search engine marketing (SEM), social, and programmatic demand side platform (DSP) buying, all saw media costs rise from their early days. These other digital media channels still today entail a plethora of human practitioner optimization needs. So why would Amazon ads optimization needs be any different?

Drive Your Campaign Train with a Well-Oiled Recommendation Engine

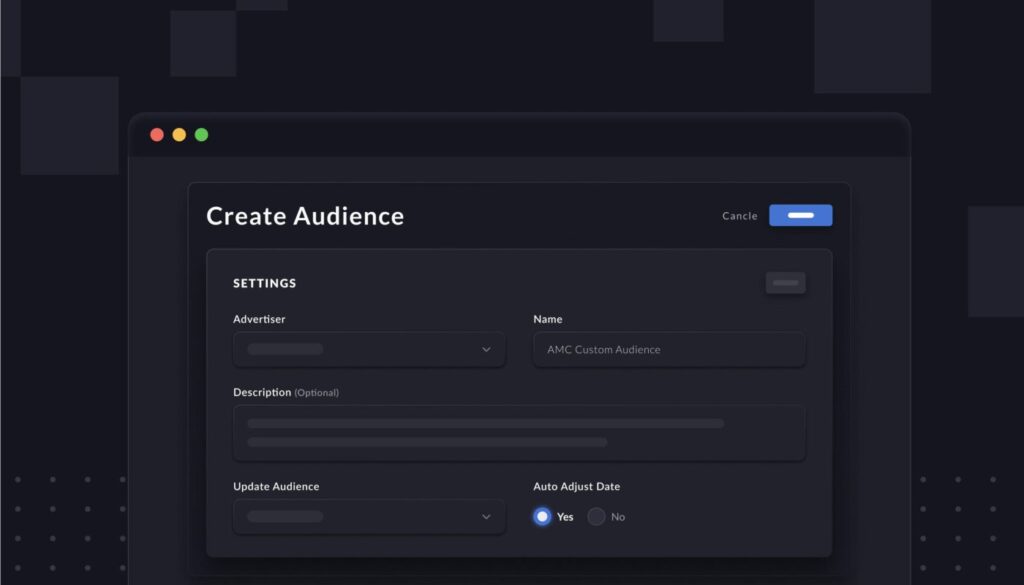

An adtech optimization recommendation engine gives an Amazon or retail advertising marketing practitioner the ability to quickly understand the various ways to make changes to campaigns to most significantly impact the goals.

Ideally, a recommendation engine prioritizes the campaign or Amazon Standard Identification Number (ASIN) recommendations based on specific goals or objectives, such as market share, return on advertising spend (ROAS), or advertising cost of sales (ACOS). Additionally, the recommendation engine can automate, via artificial intelligence or machine learning, certain repeatable tasks across ASINs and multiple marketing campaigns, while also giving the Amazon practitioner a list of detailed advertising and non-advertising recommendations. This enables the practitioner to quickly make campaign changes in real-time. The practitioner needs to be agile when pulling levers manually for many different reasons, such as changes due to seasonality, running deal events, or assortment adjustments of ads.

The recommendation engine should help the practitioner prioritize which actions to take and forecast the potential impact of the optimization changes. It’s not realistic to think the campaign practitioner can act on every single possible optimization. Therefore, the recommendation engine needs to learn over time to prioritize the recommendations based on the goal of the campaign and what will have the biggest impact on moving the needle on ACOS, ROAS, market-share goals, etc.

Fuel the Recommendation Engine with Data

A “retail-aware” ad optimization recommendation engine must be based on advertising data as well as non-advertising factors, such as inventory levels, pricing, competitor proximity, and reviews—all of which influence campaign performance in dramatic ways. For example, enabling ads for products based on inventory levels, or connecting ads and inventory, is an important media optimization tactic.

One way practitioners can combat increased marketing campaign costs and competition within Amazon advertising is to diversify digital retail media spending across other marketplaces. A recommendation engine needs to incorporate Amazon as well as the emerging marketplaces of Walmart, Instacart, CitrusAd, Criteo, and others, so advertisers can move money across marketplaces in response to where consumers shop.

However, Amazon is still the 500-pound gorilla where consumers live and buy. The Amazon advertising business is 15X the size of Walmart—its nearest retail marketplaces competitor. Both companies recently published and broke out advertising revenue numbers separately for the first time, with Walmart clearing $2.1 billion worldwide and Amazon reporting $31 billion in 2021.

No, Robots Can’t do This For You (Yet)

We are a long way away from humans “leaving the building,” and AI running campaigns with the push of a button. The concept of AI/machine learning doing all the campaign optimization, with little to no human intervention, is just not happening anytime soon. Brand and agency retail optimization practitioners know this all too well. Today, a brand either employs internal digital-media staff, or hires one of thousands of digital agencies that exist across programmatic or biddable media worlds—who employ humans tasked with optimizing spend within a given media channel or across channels.

That isn’t to say you can’t and shouldn’t use AI/machine learning technology to automate optimization and marketing campaign processes wherever possible, but push-button software solutions in the adtech space are fantasy, for now.

I firmly believe meticulous Amazon campaign optimization strategies and tactics will be needed as 2022 continues—and a lot more sources of data for targeting, too, but that’s an entirely different article.