Later this week, when Prime Day is over, you’re probably going to start evaluating your strategy. You’ll look at your ad campaigns, and you’ll ask: Which ones worked?

These questions are often harder to answer than they seem.

Sure, you can break out all of your ad campaigns, and calculate your ACOS numbers for each. If you ran similar campaigns last year, you can compare your ACOS, NTB rates, and more year over year.

That’s a good place to start. And in the Intentwise platform, for what it’s worth, you can do this easily with Prime Day drop-downs in our date range picker. (Amazon has its own date-range compare.)

But just comparing the ACOS or NTB numbers for your ad campaigns only tells you part of the story. If you ran an awareness-focused ad campaign, your direct ACOS on that campaign might not be great—but that campaign still could have done its job.

For years, brands and agencies had no way to build a truly dynamic view of how all of their ad campaigns on Amazon worked in tandem. Now, however, you can forge those connections.

In doing so, you can also figure out if you advertised at the right time. Which day was the best for ultimately driving Prime Day customers?

Let’s show you how.

The need for a dynamic understanding of Prime Day ads

If you have a sophisticated Prime Day strategy, you’re probably running a bunch of different ad types both ahead of and during Prime Day.

Your average shopper is encountering a lot of different ads from your brand: Sponsored Brands, Sponsored Products, DSP, and more.

To evaluate their effectiveness, you’ll want to answer two questions:

#1. How do these ads work together? Let’s say you run an awareness campaign two weeks before Prime Day. Did those customers later see a sponsored ad from you on Prime Day, and then convert?

Unlocking these insights requires connecting shopper interactions across your ad types and building a full-funnel view of the customer journey.

#2. Should you start your campaigns sooner? Later? You also may want to understand the day on which these ad campaigns were most effective.

Is advertising for Prime Day two weeks in advance actually worth your investment? Or are customers simply in browsing mode, and you’re losing money paying for expensive ads ahead of Prime Day?

Building your Prime Day analysis in AMC

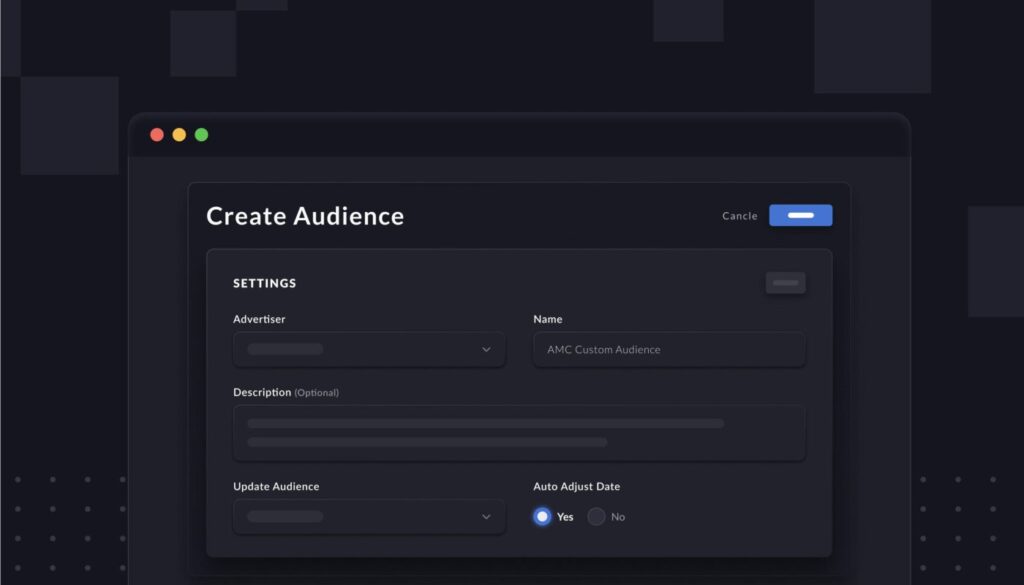

In Amazon Marketing Cloud (AMC), you can answer these questions in a few different ways. You can start with Amazon’s instructional queries, which are pre-built by Amazon.

They offer a good starting point, but they are not tailored to your needs, so they can only get you so far.

Tentpole Phase Overlap. This query is specific to major shopping events, such as Prime Day or Black Friday. With the Tentpole Phase Overlap query, you can break your ads into three distinct phases: the lead-up, the event day(s), and the lead-out.

With this query, you can see how your ads performed across each three distinct stages. What was the ROAS on shoppers who engaged with your ads in the lead-up to the event?

Time To First Purchase with Extended Lookback Window. Amazon’s Time To Purchase queries measure how long shoppers take to buy from you after first seeing your ad.

How many bought your product 0-6 hours after seeing your ad? How many bought 10-20 days later?

These results aren’t the most helpful for a Prime Day specific analysis, since Prime Day is exceptional in many ways. But they can still tell you how long your shoppers usually take to buy from you after seeing your ads.

We recommend: Build a custom tentpole query

These instructional queries offer a good start for your Prime Day analysis. However, we have found that, with a few modifications, you can get even more granular insights.

Our AMC team recently built a custom query that can show you the most optimal time to begin advertising during the “lead-up” before a tentpole event. Here’s how it works.

Step 1: Isolate all of your data around Prime Day purchases (October 10-11). In AMC, you can create an anonymized data set of all of the shoppers who bought from you during Prime Day.

Step 2: Backtrack and see how and when those shoppers found you. You can set an attribution window as large as 28 days. You want to know: What was the first impression that this purchaser had with your brand? And what other ads did they see or events did they take along the way?

Step 3: Analyze.

In our tentpole query, we grouped all of the shoppers into cohorts based on the date when they first saw an ad from your brand, labeled first_impression_date. This is the first touchpoint that each shopper who eventually bought on Prime Day had with your brand.

We then aggregated performance metrics like NTB customers or unique purchases by these cohorts of shoppers.

Want to quickly see which first impression day was the most lucrative for you? Go into the unique_purchases column, and sort it in descending order.

That way, you’ll be able to identify which first-impression days ended up bringing in the most Prime Day shoppers.

If you want to know which advertising day referred the most New-To-Brand customers? Same logic: Sort the NTB_customers column into descending order.

When you do this, you might find that the highest number of shoppers who later bought your products had their first impressions weeks before Prime Day. That suggests that your early ad strategy worked.

Alternately, you might find that most of your Prime Day shoppers had their first impression with you the day before Prime Day, or even on Prime Day itself.

If that’s the case, you need to evaluate whether your campaigns during the lead-up period were performing adequately, or if, next time around, you need to start increasing bids and getting more aggressive in the weeks leading up to Prime Day.

You can then apply all of the learnings to future sales events, like Black Friday. If you’re finding that advertising 2 weeks in advance worked well this Prime Day? Then you should consider doing the same in November.

(Want more content like this? Be sure to subscribe to our newsletter.)