We have been in conversations with many of our clients over the past few days, and we’re seeing a broad array of scenarios in which they’re finding themselves due to Coronavirus (COVID-19). Some have seen a massive spike in sales as if we were in a holiday season. And while that’s generally good, some are running into inventory issues, mainly because factory capacity is not back to full tilt. On the other end of the spectrum, clients have had their Amazon orders come to a halt, and they are concerned about the future.

The one thing they all have in common is that they are re-evaluating their Amazon advertising plans. And while no one can be certain what the immediate future holds, here is our current perspective.

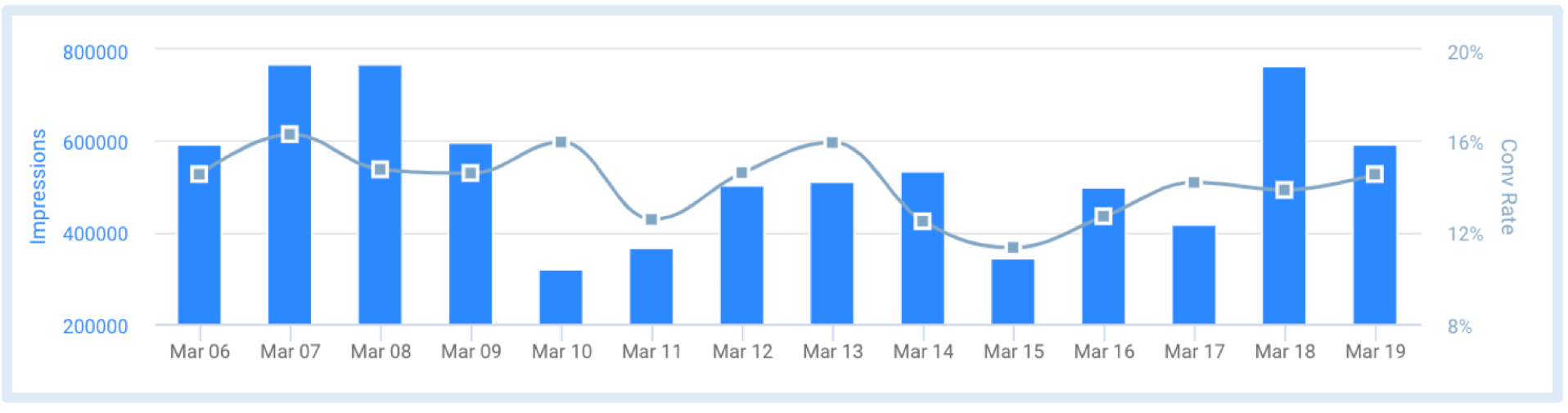

In the near term, there are two metrics to keep a close eye on:

- Impressions: This is indicative of overall demand. Shifts in trend here will influence ad spend levels.

- Conversion rate [Conversions / Clicks]: This is indicative of the willingness to buy. Changes in the trajectory of this metric will influence the return on your ad spend. (Meanwhile, we know clickthrough rates are on the rise.)

From an advertising perspective, we recommend taking action in response to these two metrics when it comes to budgets. With Amazon prioritizing essentials and pushing ship dates out on non-essentials, we anticipate that conversion rates could be adversely impacted (for non-essentials).

But if you are in a category where these are holding steady and even doing well — and inventory levels are not a problem for you — you can stay the course for now. And as things are rapidly evolving, everyone should stay on the lookout! We do expect some advertisers to pull back regardless, which in turn would lead to lower CPCs, and this may ultimately be an opportunity for some of you.

From a longer-term view, events like this result in a step-function change in buying behaviors. We have seen this happen in 2001 and 2008-09.

The spike in the essentials category sales on Amazon in the past few days is in part because of what would typically be offline demand shifting online. This shift is habit-forming, and a good chunk of that demand will likely stay online permanently. The move to digital will be accelerated. Hence, eCommerce channels will be even more crucial than before. So, whatever your near-term situation might be, when we have all weathered this storm, gearing up to compete effectively in eCommerce is hyper-critical.

We would love to hear any additional thoughts from the broader community. Feel free to reach out to us if you would like to discuss your advertising strategy in these uncertain times. We will be sharing updates as we learn more.

Read our post “CTRs increased significantly over the past 4 weeks. Here is why.” to better understand the impact of the pandemic on Amazon Advertising.