The thing about e-commerce marketing is that it isn’t getting any simpler.

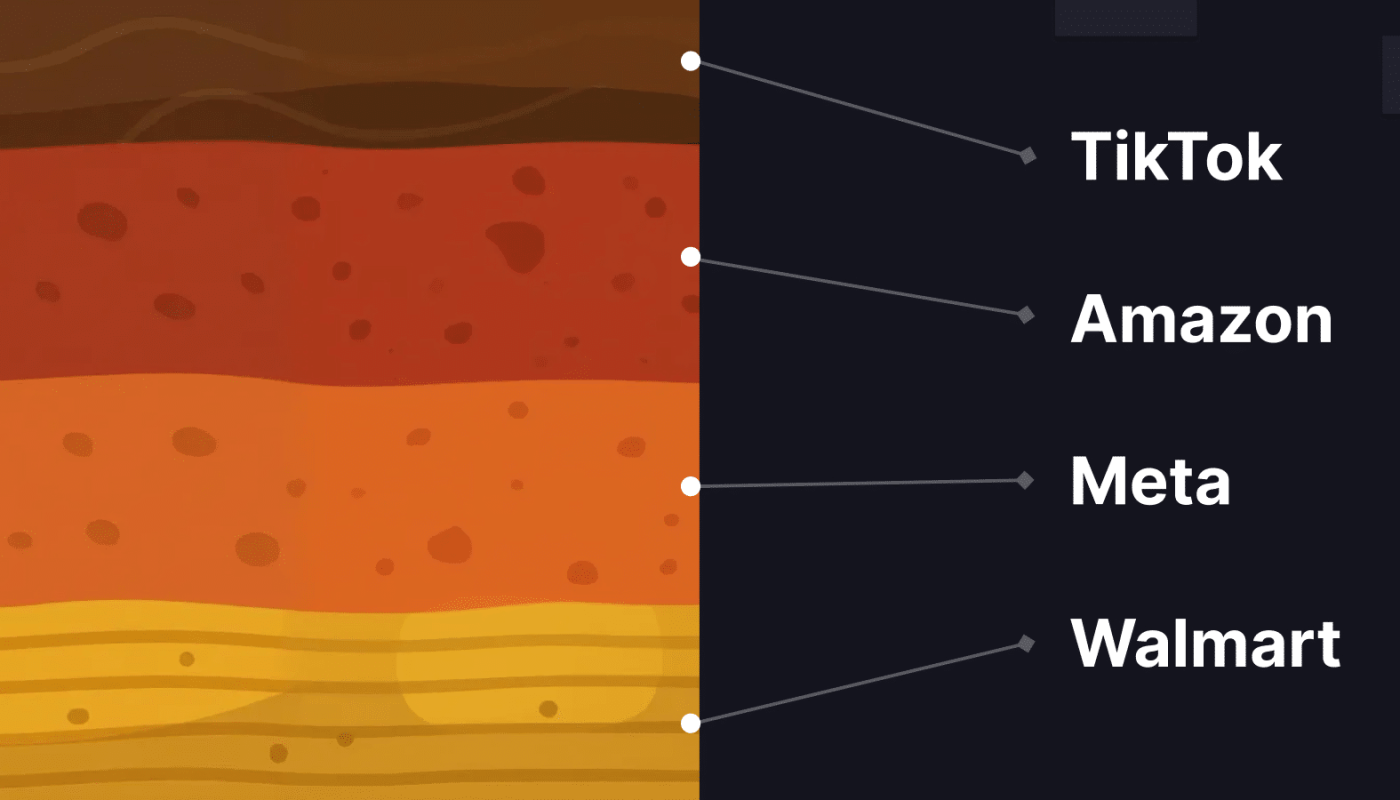

Every year, brands seem to embrace a new spate of marketing and sales channels. Amazon, Walmart Connect, Meta, and TikTok in particular have become table stakes for digital advertisers.

The typical brand, in fact, now advertises across 6 different retail media networks.

These platforms all bring with them exciting possibilities for reaching shoppers—but they also create a ballooning data unification problem.

Basically: It can be incredibly difficult to see how all of these channels fit together in your marketing strategy.

If you’re advertising across 6 different platforms, how do you make sense of which of those channels are actually working?

Is there a way to draw connections between shoppers and ad spend across all of those platforms?

Here are some preliminary thoughts on how to draw connections across multi-channel data sources.

Tracking ad performance on retail sites that partner with Amazon

It probably helps to think of these platforms in terms of buckets. Up first: third-party retail media networks.

You may already know that you can run ads on certain retailer websites directly from your Amazon Ad console.

We discussed the Amazon Retail Ad Services new service in more depth here, but basically, Amazon is now selling its retail media network as an infrastructure service to other e-commerce platforms.

For brands, that means you can run ads—from within the Amazon Ad Console—on all of the participating retailer websites, and then see the performance data alongside the rest of your Amazon advertising data. Among Amazon’s highest-profile partners so far is Macy’s.

Tying social media ads to digital purchases

All of this gets more complicated when you start to layer in marketing on social channels like TikTok or Instagram.

These platforms are at the center of the e-commerce ad market. In particular, TikTok Shop, TikTok’s own e-commerce marketplace, is finally getting the embrace of more established brands.

But how do you connect your performance on these channels to your sales on other platforms?

For DTC: It’s easier when you’re selling on Shopify. Both Meta and TikTok have ad-tracking pixels that you can embed on your DTC site.

So they’ll be able to tell you when a shopper visits your DTC site, adds a product to cart, or makes a purchase after first interacting with your ad on TikTok or Meta.

For Amazon: If you want to attribute a sale on Amazon back to your TikTok or Instagram ad, it’s a little more complicated, but still possible.

One method is to use Amazon Attribution, a service that lets you trace the sources of offsite visitors to your Amazon product detail page.

Amazon Attribution is an imperfect measure, but it can give you a rough sense of how many shoppers are clicking on your Amazon links from within TikTok or Instagram.

Curious to know more? We talk about this and other ways to attribute TikTok ad performance over here.

Attributing ad spend back to in-store sales

The rise of e-commerce has not actually done much to kill physical retail. In fact, digital marketing and in-store shopping is now more interlinked than ever.

If you’re a brand with a presence in any physical retailer, you need to be thinking strategically about the connections between your digital campaigns and your in-store sales.

Let’s go platform by platform.

Some retailers, like Walmart, make it easy to track the overlap between digital ads and in-store shoppers. Walmart Connect can attribute in-store purchases back to an online ad, so you can really see the impact of your digital campaigns.

We talked about how one of our clients, Advantice Health, benefited from this in-store sales analysis here.

On Amazon, you have a series of options for tying your ads to in-store sales. On one hand, AMC contains a paid data set called NCS CPG Insights Stream that gives you modeled data on your offline sales from 20+ major national and regional CPG retailers.

You’ll be able to see a rough estimate of how your ad spend on Amazon translates into offline sales across numerous retailers.

We discuss NCS CPG Insights stream, alongside many other FAQs about AMC, in our dedicated AMC Learning Hub.

Or, if you want to get really granular, you can also upload a list of your in-store customers to AMC, and then link those shoppers to Amazon’s shoppers. You’ll be able to add these in-store purchases as a node in the purchase journey.

Did those in-store purchasers first see an Amazon ad from you? Did they buy other products from yours on Amazon after making an in-store purchase? Now you’ll be able to find out.

(For what it’s worth: You can do the same thing with your DTC shoppers, if you want to draw connections between Amazon and your Shopify store. We talk more about the benefits of first-party uploads, including how Intentwise smooths out the process, here.)

A faster hack: Bring all of your data sources into Intentwise

Intentwise can be your unification point for these different retail media channels.

Imagine analyzing your performance across these disparate data sources, within a single hub. That’s what Intentwise can do.

Our platform eliminates your data blind spots. We make it easy to upload your first-party data to AMC, for instance, meaning you can easily forge links between shopper behavior on Amazon and purchases on your DTC site.

We also bring in data from TikTok, Walmart, Target, and many other platforms, so you can really quickly tie together cross-platform performance.