For this episode of Expert Connect, I spoke with Stephen Tyler Reagan, the VP strategy and client services and co-founder of Amazon consultancy firm Macarta. Reagan, who is also an Intentwise customer, offered some tips and best practices leading up to Amazon Prime Day 2022. Watch or read our conversation below.

Jason Chan: Our goal today is to get our listeners ready for Prime Day. For some companies, this can be one of the most expensive learning experiences, if they don’t know how to approach it. So that’s why we are connecting with you today. Now, without giving away too much, because we’re going to dive a little bit deeper in just a minute—what did you learn last year during Prime Day that you are incorporating into your plan for this year at Macarta?

Stephen Tyler Reagan: Biggest kind of takeaways I think from last year is not marrying myself to one strategy. Obviously the last two years have been a very unique time for all of us to be living and buying and helping people market and sell effectively online. I always like to look backwards to try to inform the future, of course.

But of course, with Amazon, it is a constantly evolving animal, and trying to compare with last year is even a unique challenge in and of itself, because obviously Prime Day fell in June, which, just a month out here from this year’s Prime Day. But that is a drastically different time to be selling depending who you are and your brand. And one really unique difference is just that this year, Prime Day will be in Q3. So something that’s very important for brands and their budget planning.

And so all of that being said, I think the biggest takeaway like I said, is not really getting handcuffed to any thing that I think I know for sure, and really just being nimble, agile, and very closely monitoring performance, so we can kind of lean into what’s working and get ahead of what isn’t, basically.

JC: Let me frame this for the rest of our conversation, for our listeners. We’ll be talking about three different areas: lead up to Prime Day, Prime Day itself, and lead out, or post-Prime Day activities. And by the way, I think that what we’re about to dig into today can be applied to any major shopping event. You might have different lead up or number of days, if you will. But let’s jump in and start talking about some of the activities you’re doing right now, and some of the conversations you’re having now with your clients for Prime Day.

SR: A lot of the conversations that we have with our partners around Prime Day really started six months ago. Prime Day has become such a mainstream opportunity for brands. Of course, on Amazon. But even—you look at your Best Buys and your Walmarts and any other retailer, really, Amazon has disrupted the way we buy things once again. And you’ll see the big deals coming out kind of around Prime Day to really combat and try to compete with Amazon. So point of that is, this has become a much more bona fide component of our planning that we have with our partners really at the beginning of each year from a budget perspective. And really, it’s about how do we maximize this huge opportunity that’s becoming, again, more mainstream, and just a proper component to people’s marketing strategy at the beginning of the year.

JC: So what are kind of some of the tactics leading up to it? What do you recommend that people do right now in terms of maybe taking a look at the data, for example? What are the specific metrics you’re looking at that you’re analyzing from the previous year that you’re applying, maybe this year?

SR: A lot of the most important numbers—or metrics, rather—that we sort of reference or consider from years past—really around exposure, engagement, and cost per click, basically. Of course, every category, every brand will behave somewhat differently. But we like to kind of roll up information at a segment or category level to really understand what’s happening sort of beyond just one individual brand specifically as it pertains to the cost of acquiring customers or at least clicks, sort of leading up to, during the event, and then obviously in this kind of tail-out period.

So really, it’s about efficiency. Your return on ad spend or your advertising cost of sale, click-through rate, for some kind of engagement measurement. And then overall impression volume, that’s kind of a—you know, you don’t put impressions in the bank—but it’s always a really fascinating signal about just the wealth or rather the size, the volume, of people who are coming to Amazon ready to buy and most of them looking for a deal, expecting a deal.

JC: Do you have a checklist of what needs to be done in terms of the marketing side? For example, there’s Amazon storefront, you know, retail readiness. What are you looking to do in the Amazon storefront, for example?

SR: Within the storefront for any of our brand partners, as we really get into Prime Day, it’s about what kind of message does the brand want to communicate, and really, where do we want to win? So that really informs how much we want to really blow up the brand store. We’ll do a lot of things, kind of as a temporary store-takeover type of a concept, where we work with the brand to align on, again, where do they want to win? Are they running any promotions? And then looking to merchandise that experience and create an environment for shoppers to really get the most out of the time they spend within this sort of store environment and experience within the walls of Amazon.

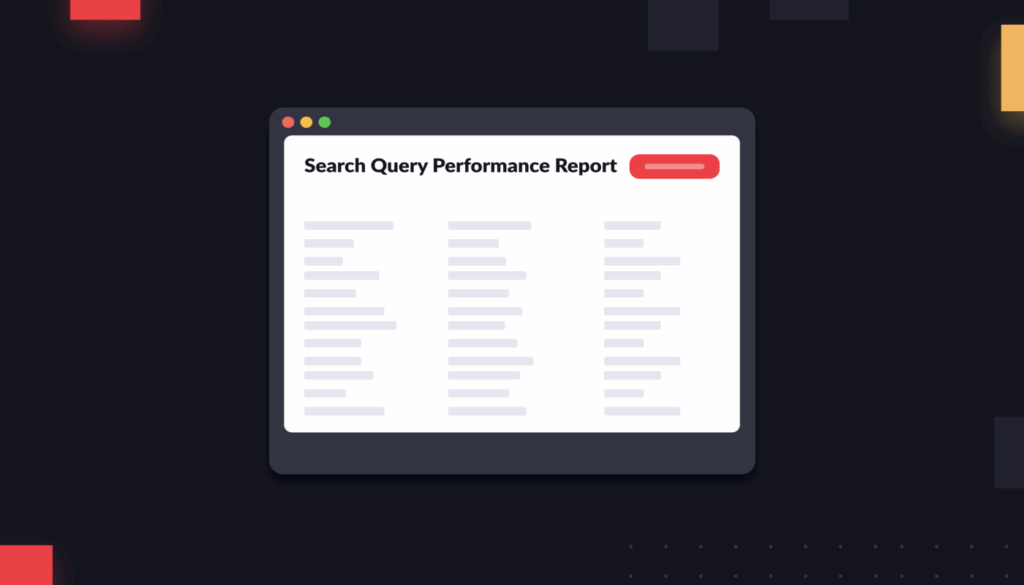

The retail readiness is, of course, hyper important during these events, but it is always a critical component. And thinking about data from last year, we really dig into customer search terms and keyword intelligence. Thankfully, Intentwise helps us really pop the hood and look backwards, but with a fine level of granularity. And that helps us really understand what was working from a keyword perspective and how do we incorporate those messages, those concepts, sort of trends, if you will, within every touchpoint that a customer might have with our brand partner on, before, during, and after Prime Day.

JC: For Amazon storefront, I’ve seen a lot of stores mimic their website. And they may schedule banners to have teasers and then Prime Day, they’ll have that exact promotion. Are you doing anything like that, to tease these sellers—”Hey, get ready for Prime Day?” Or do you actually start promoting and selling before that event?

SR: Amazon obviously has some pretty restrictive—they have some pretty lofty restrictions in terms of language, and how much we can sort of tease that deals are coming and get ready, buckle up type of thing. That being said, we don’t lean into a huge sort of pre-event communication in that respect. It’s really more about really increasing our level of aggression, if you will, or just the investment as we lead into these events.

I mentioned earlier that Prime Day is so mainstream and everybody knows it’s coming, they get excited. Amazon has done so much of the heavy lifting to really communicate that. So in the weeks leading up to Prime Day, it’s really about continuing to drive traffic to our brand store environment.

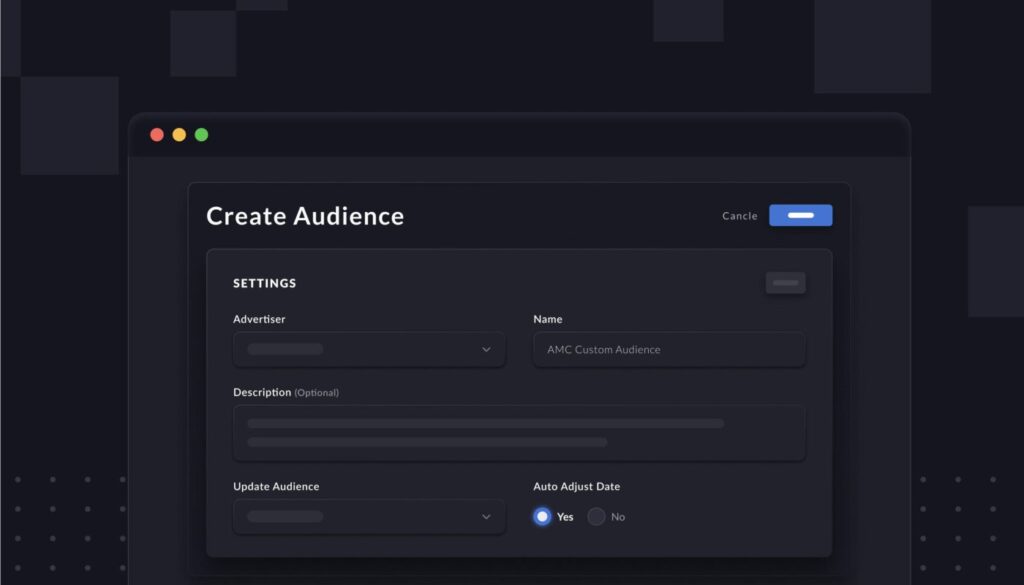

Beyond that, it’s really building a viable pipeline of shoppers, if you will, when it comes to things like display remarketing, where we can really use this window of time where there’s just a crazy amount of traffic to feed our sort of custom audiences that we’re going after, if we’re looking to sort of remarket to these customers who maybe didn’t find the right deal from our brand partner, but we want to continue to stay in front of them post-event.

JC: Are you conducting any sort of Amazon experiments before Prime Day?

SR: For experiments on Amazon? Absolutely. I mentioned earlier that what I don’t want to ever do is really rock the boat, if you will, and make drastic changes. So our planning really, again, started six months ago, formally, really probably three months ago, in a more meaningful way. So that’s really your opportunity, I think, to properly A/B test.

Prime Day has so many just variables that make a proper test really tough to measure. So we really try to kind of air out those question marks, if you will, as far as our positioning, and how do we really want to maximize some of the content components on Amazon, things like A-plus experience as well as brand store sort of engagement and efficacy. So my point is, from an experimentation standpoint, we really try to do those well in advance of Prime Day, so that we have a solid understanding of what’s going to work driven by data.

JC: For those who don’t know what Amazon experiment is, basically what you could do is test your A-plus content, your image, and your title. The reason why I love Amazon experiments is because, versus services out there, it’s a network of paid panelists. With Amazon experiments, customers are voting with their wallet. So you’re swapping out different images, different A-plus content, and title. Advertising—are you doing anything leading up to Prime Day? Are you increasing budget or decreasing? What are you doing exactly in that regard?

SR: So from an advertising perspective—and I’ll kind of focus this in on search advertising through Amazon sponsored ads—we’re talking a lot today about sort of this trifecta around Prime Day, really this lead-in period. And regardless of whether Prime Day happened in June last year, or October the year before, or July the year before that, there has been a very consistent sort of build up, then a pinnacle to this event, and then sort of this tail-out period. So really, by looking at a handful of metrics, specifically click-through rate, total impression volume, and efficiency from a return on investment standpoint, how did those ebb and flow throughout the sort of lifecycle of a Prime Day event?

So I think the fun part for us is really having those conversations with our brand partners and really trying to think outside the box. Typically there tends to be sort of a post-event lull in terms of cost per click and things start to sort of normalize. And so that presents almost a void in the search landscape that we might be able to really capitalize on because a lot of these big brands, especially your kind of global or large national brands, it’s all about Prime Day and all the promotions that they’ve lined up months ago. So once that deal is over they kind of have to reel things back in. That has created a bit of a void, I think, in sort of competition.

But beyond that, it’s really being very, very close and very nimble as far as what’s happening for this year. We’ll really start to pull some levers, if you will, and allow campaigns to spend more money and spend at a higher cost per click. About the 1st of July, that’s been pretty consistent with what we see in the years past and sort of this 30-day window. One data point that I will share, what we see from a cost per click perspective is the two days of Prime Day last year, they were 30% more expensive to acquire or to generate a click. I’m going to run that back again—your cost per click during the event last year, at least what we saw, was 30% higher than the trailing two weeks before that.

What is fascinating is that the lead-in period is much longer and then that tail-out period, things really normalize back to kind of that pre-event average cost per click within about seven or eight days typically. So it’s really kind of understanding and more than anything, setting those expectations with ourselves and also with our brand partners that it is going to be more expensive, period. And then you start to think about what else is a brand maybe doing from a promotion standpoint? And if they’re running all these lightning deals or these deals of the day, things like that, that same increase in cost is happening. But yet you might be pulling in 20% less on a retail sale amount. So it really starts to tank some of your efficiency metrics, your ACOS (advertising cost of sale) or your return on investment (ROAS).

JC: Did I leave out anything that you would might do leading up to Prime Day?

SR: One additional thing that we really, really lean into, if you will, from a planning and preparing preparedness standpoint around Prime Day is with our display advertising team. That is obviously a much different animal than paid search. And it’s a longer-tail sort of strategy in a lot of ways. It’s a longer term strategy, I should say.

So from a kind of an audience planning perspective, that happens even earlier than any of the kind of bigger changes we’re making from a search perspective. And it’s really about making sure that we can find a relevant, the most relevant audience with an element of recency. So trying to understand, what are my customers really looking at? Where are they browsing? Where are they looking in the last 45 days? And that’s going to just help me understand what we might be looking at as we get into the next 30 days into and around Prime Day. So I think audience viability is a huge component of what we do from a display advertising perspective.

JC: So in other words, you might be running sponsored display ads trying to figure out what your target audiences are, trying to fine-tune that for Prime Day?

SR: Well, I was actually referring to Amazon’s DSP advertising, so not strictly within Sponsored Display. Obviously, Sponsored Display presents a really unique opportunity. And it’s kind of this DSP-lite, if you will. But Amazon’s demand-side platform really provides a rich understanding of who your customers are—where are they living, one, but what else are they buying? And that really helps inform brand stores strategy as far as adjacent relevant category targeting or really trying to put ourselves in these shopper’s shoes and create this environment within the store within A-plus, ad copy, and creative that meets them where they are and what they like to do even above and beyond our brand or the product that we’re advertising.

JC: Let’s transition over to Prime Day now. This is kind of the main event. The day of the event, what are you working on specifically on that day? What should we as advertisers be looking at? Brands, what should we be focusing on?

SR: So on the on the day itself, it’s a lot of buckle up and really follow what’s happening. Thankfully, Amazon is able to surface a lot of nearly real-time information. And we do work obviously very, very closely with Intentwise, and set some rules in place prior to the event to really allow these budgets to go well above and beyond what we had been seeing on a trailing 30-day average kind of a thing.

But our entire search team is really watching things like a hawk across the board and really working with their counterparts on our brand management team, who will be looking at some of the operational components, obviously making sure there’s no flags or no suppressed ASINs, things like that. And with this crazy influx of traffic, things happen, right? So, you know, the best we possibly can do is try to get ahead of these potential pitfalls. But staying very close throughout the day and sort of the 72 hours before and after the event to make sure that from that operational perspective, as well as advertising, we are able to spend and really to walk through the strategy that we’ve lined up.

JC: Are you using kind of maybe social media or Amazon Posts to draw more attention to the offering?

SR: So when it comes to things like social media or obviously Amazon Posts—their sort of Instagram-style feed that that’s not so new anymore, but it’s definitely becoming more widely adopted—we look at that in a similar perspective as the brand store. It’s really building some momentum well in advance of the event. We will work with our partners to find some imagery or some user-generated content, anything we can repurpose from other social channels to just get as much content out there as possible.

You know, Amazon Posts—it has been a component of our strategy by and large for, I guess it launched in maybe end of 2019. There’s still not a ton of information that we can really action from that other than sort of exposure and how many people saw it, how many people clicked it. I’m sure over time, there’ll be a lot more behind that. Things like revenue and maybe an ability to boost those posts with money. But more than anything, it’s about kind of matching the story and the tone of voice that our brand partner is really looking to communicate in general on Amazon, but more specifically around these events like Prime Day.

JC: How about promotions? There’s different types of promotions on Prime Day, right? If you missed the deadline in April, you have other options of maybe discounting coupons, maybe different types of promotions. What have you seen work percentage wise, dollar amount wise, in your experience?

SR: When it comes to promotions, I’m a bit of a skeptic sometimes, primarily with things like lightning deals. Anymore, there are so many lightning deals and so many deals of the day and things like that where you’re sort of lost amidst this sea of other big promotions. That being said, they work. I think the efficacy is really predicated by what else are you doing to get people in front of these promotions and enter Amazon advertising, right? So, I think to really maximize promotions, it’s really about again, giving that exposure in every possible way that exists on Amazon. So of course, search advertising to make sure we’re emphasizing these promoted products. Creating some experience or destination within the brand store that is nothing but deals.

In terms of my experience around impacts with like anything, the bigger discount and the more recognizable brand or name tends to perform better just by and large. It is something that—a lot of our partners have a pretty deep relationship with Amazon directly. And so they really lineup all of these best deals or deals of the day, things that they’re going to be doing as a retail focus or rather an internal sales-driven tactic. And so that’s definitely an interesting observation from my end, is that the promotions tend to be very much focused around a sales opportunity and less so about building momentum from a marketing angle.

A lot of times, people will try to offload inventory or aging inventory with an event like this. I do think Prime Day is certainly unique from a promotional standpoint, because everybody’s expecting a deal and there’s almost an opportunity to not necessarily discount your products because everything else is on sale. And unless you’re wildly outside of the average price point, people kind of assume it’s on sale anyways with or without a badge or a big call to action about the discount amount or dollar amount discount.

JC: How about advertising? What are you adjusting for day-of advertising? What is your team adjusting? Is it budgets—you’re increasing CPC by X amount? Also, are you creating specific campaigns just for Prime Day or you seasoning campaigns kind of before and running into Prime Day and then closing it down?

SR: One of the things I mentioned earlier is not looking to make any knee-jerk reactions. And I think part of that really also ties into not creating things two days before Prime Day. You obviously at Intentwise are kind of the expert in terms of Amazon’s—rather a new campaign ramp and sort of this relevancy component. And we see it as well. A campaign that has some history and some equity will tend to perform better than something totally new.

And so what we really try to do is tweak some evergreen campaigns for a short period of time, throughout the month of Prime Day, whatever month it falls in. And so the point there is to leverage a campaign that has established momentum and equity as it comes to that search term relevancy to the products we are promoting, and then using those existing campaigns to really increase bid levels on keywords that we see to be effective, or that our brand partners are really wanting to win in, if you will.

So beyond that, it’s definitely allowing our campaigns to spend more with a healthier daily budget, making sure that we’re not hitting those caps on the days themselves, and if so, making sure that we can expand them straight away. We really try to inform what we think each campaign will spend by looking at similar segments or strategies from the years past.

And all of that is really to try to get kind of a plan A, a plan B, and a plan C together that we’re going to go in looking at a particular daily level of spend. If we see X, then we’ll be able to move into that sort of next tier of investment, and it’s really to balance the fact that this is two days and we still have 363 more days to invest. So we can’t totally overspend, if you will. So it’s about increasing aggression with some pragmatism to understand that there’s more fun to be had later in the year.

JC: How about off-Amazon advertising? Do you do any work with your clients with their Google ads or email campaigns?

SR: With regards to outside Amazon advertising and specifically outside of Amazon’s DSP advertising, that’s not something that we execute. However, it is certainly more so in the last, I’d say year, year and a half, becoming a much more mainstay or front and center component of our broader strategy. I don’t have any data to back this up, but it would certainly seem that Amazon really favors traffic that’s coming from outside of Amazon’s walls. The way I’ve always sort of rationalized that is that if you’re driving traffic from ESPN, let’s say, to Amazon.com for your brand, your product that you want to promote, that’s obviously fantastic. And we want to sell that brand, and Amazon wants us to to make that conversion.

But once that customer is on Amazon.com, they’re in the everything store. And you better believe that an Amazon customer coming in from off-site is going to buy the product we’re promoting, hopefully, but they might be throwing in toothpaste and toilet paper into their cart. So the the point I’m making here is that the level of importance to your non-Amazon marketing and advertising strategy to your Amazon business is just becoming so much more important over time. And I think this favorability—at least my speculation of favorability—to traffic coming in from outside certainly would make sense anyways from a kind of gut-check standpoint.

So all of that being said, the way we look at and really consult and speak to our brand partners about outside Amazon activity is as long as it’s within brand goals and broader marketing goals, we absolutely want to funnel as much traffic as possible from outside Amazon to this Amazon brand store environment or directly to detail pages.

JC: I like how you mentioned before—brands can take this opportunity to get rid of their long-term inventory items that have been sitting there stale, and put that in front of the consumer. Do you have any other strategies around Prime Day that people should consider heading into Prime Day?

SR: So from a promotional strategy, you mentioned that opportunity to move products that aren’t selling. One little comment I’ll make to that is that a product is slow moving probably for a pretty good reason. So there is kind of this balancing act of how much do I really want to invest into something that is not a long-term, very viable seller, if you will, within my catalog.

I think another really strong tactic is really using a promotion to acquire customers and launch new products. Of course, you run the risk of establishing sort of that price point precedent for a new product. But that’s always a sure-fire way to increase conversion rate, is lowering your price. So I think it can be a good strategy when it comes to introducing a new product into your assortment. Or maybe in the world of apparel, maybe a new colorway or a new style or fit, something to that effect. So I think launching new products, and promotions being a part of your go-to-market strategy for Amazon is definitely a viable strategy. And specifically in Prime Day, where there’s just so many people on-site, just a better chance to get in front of even more people.

JC: Let’s bring us to a landing. Prime Day is over—our special event, the big shopping event is over. The lead-up period. What do you do after that? That craziness just happened, right? What do you do in terms of advertising in those areas?

SR: So in the post-event days or maybe ten days, two weeks, not a lot of immediate drastic changes. I think certainly not in the first 48 hours. Really the point there is—I did mention earlier, that there can be a vacuum of advertisers, and there absolutely is. But I’m also not the first one to ever say that. So I think people are becoming a lot more attuned to this three-part strategy.

So what I’m kind of getting at is that we really let those for the most part same strategies ride for another couple of days. Amazon does have that last bid auction, and so even if we saw a 30% increase to our average cost per click, we’re going to keep those bid levels at a spot that we’ll still have the opportunity to capture sales, even if they are a little bit higher than our average cost per click. And then it’s really kind of monitoring how that performs and how that behaves in the days following and then really about ten days later, we start to kind of shift gears officially and change things around messaging within the store, as well as our pacing from a spend perspective.

JC: How about in terms of analyzing data? There’s a lot of data to go through. What are you looking at data-wise that you can maybe take that as part of learning to carry over to the next shopping season?

SR: When we’re looking at measuring the impact of Prime Day, it is really back to this kind of three-part component to Prime Day. It’s really trying to understand what our data and what the performance looks like within these three subsets of Prime Day, because even if Prime Day is the most kind of pronounced and the biggest, most widely known event, maybe besides Turkey 5—this same kind of lead in, an event, and then tail out period definitely happens. It’s just a matter of—it might be a little bit more truncated from a time perspective if it’s something around Father’s Day or Pet Day that they had in May, things like that.

So it’s really trying to understand our performance in these three different components of the event. And how do we sort of localize that, if you will, for the next event, whether it’s Turkey 5, things like that. So obviously there is an attribution window at play here. So we’re always pulling day-after information at a daily level across impressions, clicks, spend, sales, conversions, and then of course, we revisit that two weeks thereafter to really understand what was the true total impact of this event. And I always find that interesting and that’s a common practice, of course, on a monthly basis that we do to true up the numbers.

But what we’ve seen is that there is just a much deeper halo impact from Prime Day. Typically we’ll see maybe 4 or 5% more sales be attributed in those two weeks after the spend occurred. But from within Prime Day, it’s closer to 7 or 8%, which doesn’t sound like a crazy amount. But in the context of sort of a pretty sizable investment, it’s a meaningful amount of money that’s attributed back to your investment around this event itself.

JC: So before we wrap up, thank you for just all the knowledge you just shared with us and insights. What are your closing thoughts, and maybe even one more tip for the audience that we should consider during this event?

SR: Well, Jason, it’s been a pleasure. I really appreciate it. As kind of my leave behind, if you will, something I mentioned earlier, and that’s really not handcuffing yourself to one strategy. Again, Amazon is a living, breathing organism. And this element of adaptability and fluidity is—it’s not just a best practice, it is absolutely critical and mandatory in general, I would say, but obviously around these big events. So that’s kind of the biggest thing in my opinion is letting data really inform your strategy and how you want to kind of maximize the event and not getting too personally attached to any strategy or any keyword, things like that and just leaning on the data.

I think beyond that making sure that from a, again sort of a data comment, track everything, pull every single data you possibly can because this is one event. But there are so many more events that you can use this insane influx of traffic to learn from—not just Turkey 5, but little micro seasonal events that happen: Halloween, Father’s Day, so on and so forth. But the sort of lead-in event and time-out period—it really does exist for every kind of event. And then it’s about kind of localizing to what’s happening in that event, what time of year and things like that.

And beyond that it’s have some fun, and don’t get too in the weeds. I think it’s a crazy time. And as long as I think you’re tracking things at a very close level from a data perspective, advertising, make sure you have everything operationally lined up well in advance from content, ASIN structure, no orphaned ASINs, anything like that. It’s about planning ahead and then having sort of plan A, B, C, D, E, so on and so forth really in your back pocket should something not go the way you anticipated.

This interview has been edited for clarity and length.