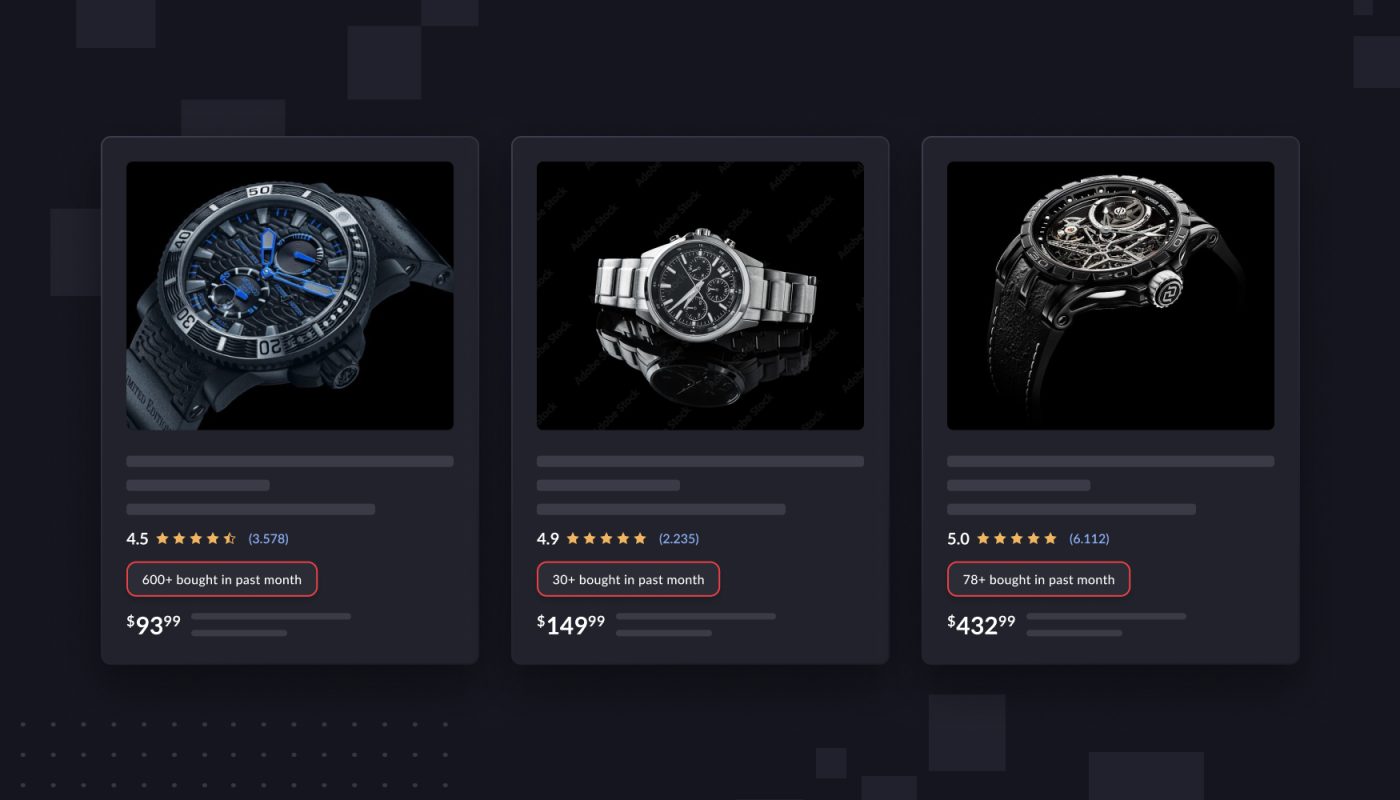

Next time you search for an item on Amazon, you might stumble across an intriguing new data point: the number of sales per month of each product.

Starting in March 2023, Amazon has begun publicly displaying the sales data for certain products. You can see tags like “800+ bought in past month” or “100k+ bought in past month” just below the star rating of a product.

This data is not available for every category, but it is quite widespread in search results on the site. At Intentwise, we’ve been exploring where and why this public sales data appears. We especially noticed it in the Kitchen & Dining, Home & Kitchen, and Sports & Outdoors categories.

The introduction of public sales is a big deal for brands. Though it is just a test for now, we think it’ll foreshadow a broader rollout. “I don’t think Amazon would reveal this information just to take it back later,” says Ryan Burgess, Head of Growth at Intentwise. “I think it’s a signal that sharing more data is the new future of Amazon.”

So who is this sales data for?

Publicly displaying sales data is, like most things with Amazon, probably intended to benefit customers first. Sales numbers may become just another factor for shoppers to consider as they browse products. Tellingly, the data is not available in Seller Central or any of Amazon’s APIs, which means that it is harder for brands to collect.

If it gets a broader rollout, this sales information could have a meaningful influence on shopping behavior. We already know that shoppers on Amazon are drawn to products with a high number of reviews. A 2019 study from the University of Arizona, in fact, concluded that the number of reviews on Amazon was even more influential than the star rating itself.

Say a customer is choosing between two products. If everything else is equal, but one product has 500 reviews and another has 50k+, customers will most likely opt for the product with 50k+ reviews.

We think a similar phenomenon will play out when it comes to sales data. All else being equal, customers will opt for the product with the higher number of sales. These products, after all, feel market tested and safer to buy. They are “social-proofed,” as Burgess puts it.

What can brands do with this data?

Even if the sales data is meant to be customer facing, savvy brands can almost certainly use it to their advantage.

A truism among sellers and brands is that sales velocity—the number of units sold in a given window—is the most important factor in determining your rank on Amazon. Tracking how your sales compare to your competitors has therefore been a major part of selling on Amazon.

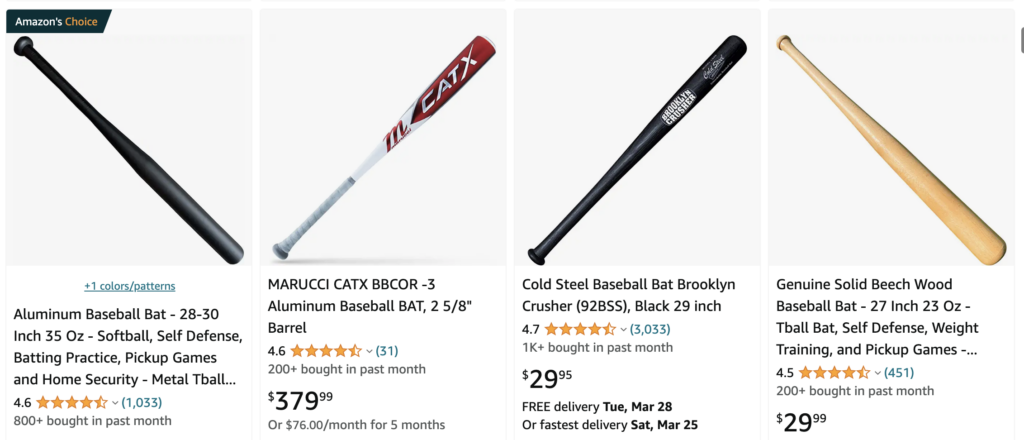

In our investigation, we found that the public sales data on Amazon typically followed the expected pattern: the highest-ranked products in search results had the highest sales velocity. But occasionally, there was an intriguing exception—a highly ranked product that had many fewer sales than the products ranked both above and below it.

See below, where we found a baseball bat with 1k+ sales sitting beside similar products with just 200+ sales in Amazon’s organic rankings:

Cases like this, where there’s a misalignment between a product’s sales and its search rank, are well worth exploring. If you see that a competitor ranking above you has a much lower sales velocity, you might consider running a competitive analysis to figure out what’s going on.

Is this data actionable yet?

The introduction of public-facing sales data on Amazon is part of a broader trend. After years of holding tight to its customer information, Amazon is making more and more of its data available to brands. It’s a huge opportunity that many are still overlooking.

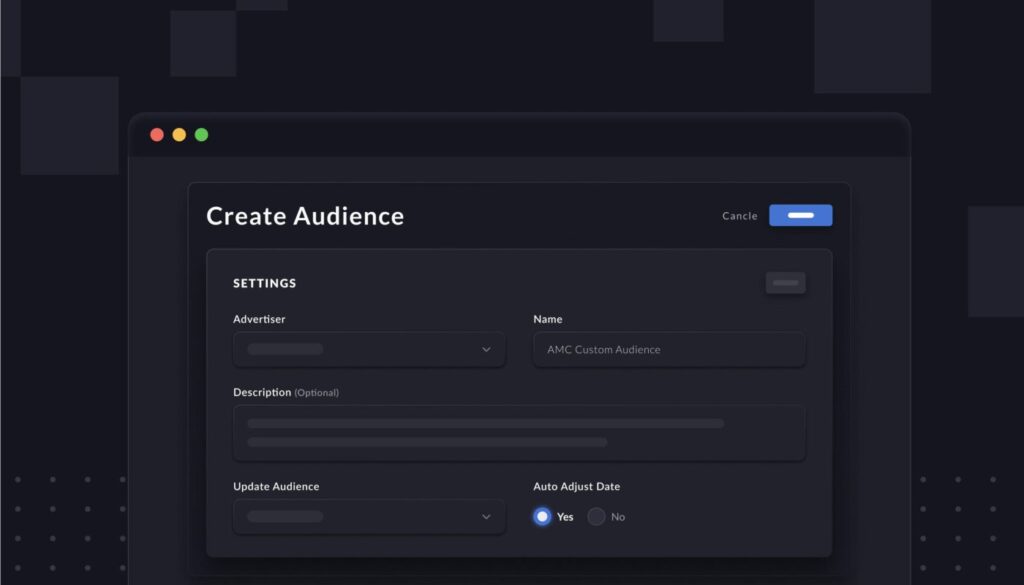

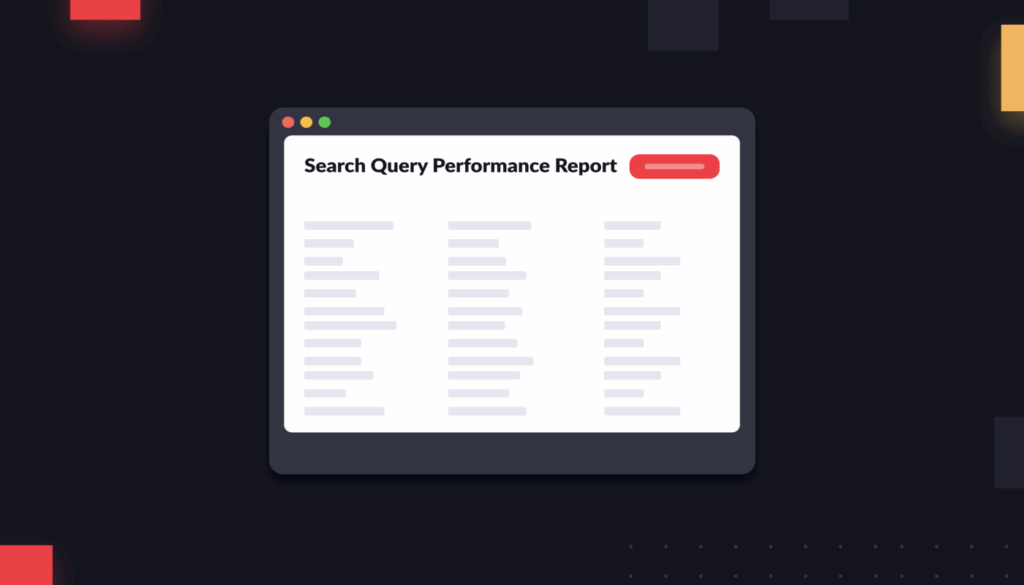

We are especially focused on Amazon Marketing Cloud and Amazon Marketing Stream, which have opened the doors to real-time advertising analytics and refined customer targeting, but we think new features like Amazon’s sales data test can also add a critical layer of insights for brands.

At Intentwise, we are already actively working on ways to pull Amazon’s public sales data into our platform and incorporate it into our Share of Voice metrics. Ideally, we want brands to use sales data to gain a richer view of how they compare to their competitors.

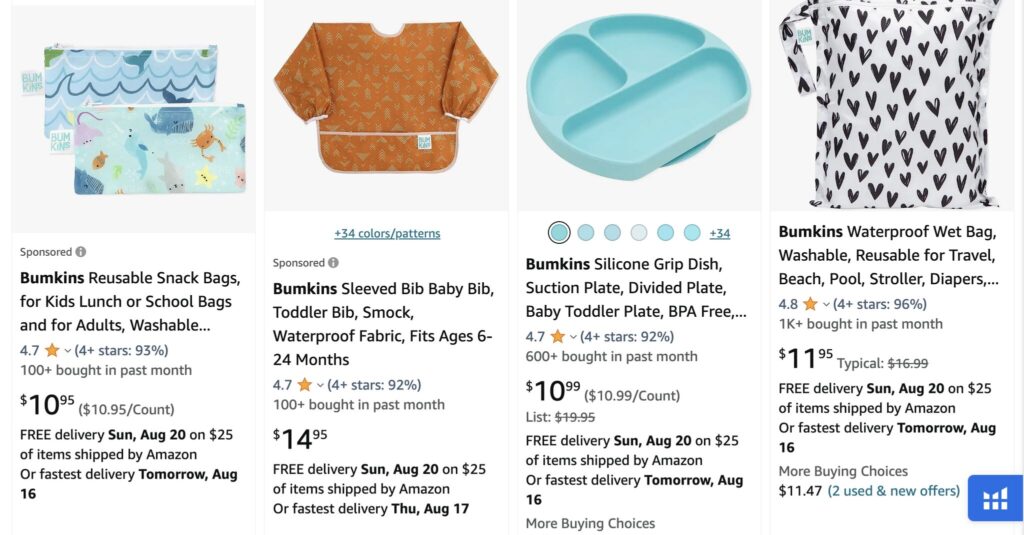

Update: Amazon is now showing review percentages in place of review counts

Tied to Amazon’s test of sales data in search results, the company is also testing out hiding customer review counts entirely. Instead of the number of reviews a product has, Amazon is showing the 4+-star review percentage for each product.

A member of our team first spotted this test in August 2023.

What does this mean? It depends on how widely the test gets rolled out. But if Amazon does begin replacing review counts with 4+-star review percentages, we think the real winner will be smaller brands.

Small businesses might have an impressive share of favorable reviews but not the volume of reviews that their more established peers can boast. These companies could benefit greatly from this new feature.