Intentwise’s CEO Sreenath Reddy hosted Rohan Thambrahalli from DimeTyd for an in-depth conversation about the importance of accounts reconciliation for Amazon vendors.

About Rohan Thambrahalli

Rohan is the founder of DimeTyd, an accounting and reconciliation platform for Amazon vendors. Prior to DimeTyd, he was the founder and CEO of Upstart Works, which is an ecommerce commercialization platform.

Topics Covered:

- Complexity in accounts reconciliation for vendors

- Efficiency in operations for 1P vendors

- External cost quotients faced by Amazon vendors

- Advice and guidance for Amazon vendors

Full Transcript

[00:00] – Introductions

Sreenath: Good to have you. Rohan. How are you?

Rohan: Hey Sreenath, I’m well, how are you?

Sreenath: Good, thanks for joining me today. For those of you watching today’s topic that we are going to talk with Rohan about is how as a 1P vendor on Amazon, how you manage your accounts reconciliations effectively. Before we do that; let me introduce you to Rohan.

Rohan is the founder and CEO of DimeTyd. I’ll let Rohan talk about DimeTyd in a moment. Rohan is a serial entrepreneur. He has been in the e-commerce space for about 20 years. Prior to DimeTyd, he was the founder and CEO of Upstart Works, which is an e-commerce commercialization platform. And I know Upstart Works has worked with a number of brands worldwide. With that, Rohan, let me give you a chance to talk a little bit about what DimeTyd does.

Rohan: Yeah. Thanks for that, Sreenath. Our goal with DimeTyd is really automate Amazon accounting and reconciliation process for 1P vendors. That’s sort of the technical explanation. But what we really trying to do is bring visibility into transparency, into how Amazon does their accounts receivables and really simplify the process and make it less time-consuming and automate that entire process for 1P vendors.

Sreenath: Got you. So you have gone from — I know what Upstart Works does, you guys have a bunch of brands with channel management across Amazon and a bunch of other channels. So tell us a little bit about how you went from that to play in the fintech space, really? Right. So can you just walk us through that transition?

[01:45] – Complexity in accounts reconciliation for vendors

Rohan: Yeah, sure. Over the last two, two and a half years, we were getting feedback from a lot of 1P vendors that there wasn’t really a good solution to help them understand and simplify Amazon’s accounting and accounts reconciliation.

Amazon has a very unique and complex way of how they do accounting and especially how they pay vendors. It’s very different than any other retailer and retailer out there. And what we realized was that for big vendors that are doing decent volume, this process was not only complicated, it was time-consuming, manual, and was causing a lot of extra work that—frankly speaking—shouldn’t be. And two years ago, we sort of really went off on this journey to solve this problem that—at that time, we believe we were hearing from enough vendors for us to really dedicate the time and effort.

And as we look deeper into this, we realized that this is a problem vendors face globally, and we thought that we would build a solution that would address this problem. It’s very esoteric, but I think it is one that is adding a lot of value to people that are currently using the platform.

Sreenath: Makes sense. So you touched on the complexity of accounts reconciliation for vendors, if you don’t mind, let’s unpack that a little bit. Besides the manual process that doesn’t have time for automation. Is there anything about the analysis itself that is complex or makes it complex for vendors.

Rohan: I think, when you kind of zoom out, there are two key things. First, Amazon has over 20 different cross docks in the US and over 200 different fulfillment centers. So, how Amazon receives the product also has a lot to do with where these accounting inefficiencies happen. When you take the complexity of their supply chain system and combine it with their accounting system, which is deduct from pay, right.

So Amazon always deducts first and pays later. Now at the scale at which they operate, it is somewhat a right methodology for them to adopt, because if they pay first and deduct later, what happens if the vendors short-ship? Then Amazon will need to have an army of essentially collectors calling the vendors and trying to get the money back, right.

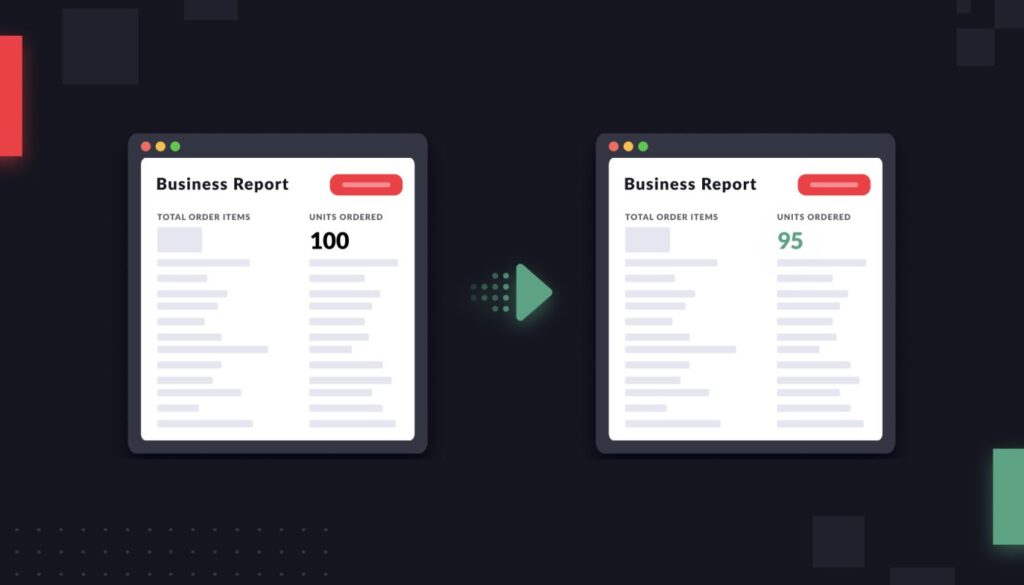

So from Amazon’s perspective, deduct first pay later makes sense. And that’s really where the complexities happen. For example, let’s say you ship 100 units. Sometimes, Amazon thinks that they received 110 units, right. And vendors always have agreed upon co-op with Amazon. So Amazon will think that they received 110 units, deduct the co-op on 110 units. But later, when they reconcile, they’ll say, hey, we actually only received 100 units. The vendor invoices for 100 units. But the extra deduction they take on the extra ten units never really gets returned back to the vendor. That’s just one very simple example of how these things happen.

And we’ve identified over 107 different instances of where these things can happen. That’s one thing, and then, the sheer volume of data is also the other big thing. Several vendors, I would say, just don’t have the ability to look at this level of data at a line item level, which is, again, a big reason why these things get missed.

[05:37] – What makes the 3P side different from the 1P side?

Sreenath: What makes the 3P side, the seller side, different from the 1P side in this regard?

Rohan: Yeah. It’s a good question, Sreenath. So the 3P side of things is relatively less complex than the 1P side. Now, not to mention that over billings don’t happen on the 3P side. The main difference here is that on the 1P side, vendors agree on many different contracts, right?

It could be a freight agreement. It could be a co-op agreement. It could be a damage agreement. It could be a promotion. And then the magnitude of these types of billing errors are significantly high on 1P side and not so much on the 3P side, because on the 3P side, the sellers are not necessarily agreeing on multiple different contracts. And that’s the big difference.

Sreenath: Understood. I know you’ve been looking at a lot of different accounts of different vendors.

[06:35] – Efficient operations for 1P vendors

Sreenath: If I were to ask you, like, what does an efficient operation inside of 1P vendor like when it comes to managing account reconciliations?

Rohan: Yeah. We’ve been working with a lot of different vendors. Different sizes from 10 million to hundreds of millions. And there’s a couple of things that I would like to point out.

Every vendor we work with has some of the best world-class financial systems and processes in-house. Now, those systems and processes are meant to effectively identify and solve a known problem. And what largely we’re talking about and trying to solve here is problems that are not known. Right.

So a couple of practices that we see that are effectively being employed by some vendors, they are really looking for the anomalies in their billing first. Secondly, looking at trend data. Right. So if you see that, hey, you know what, our shortage claim is increasing month over month. Why is that happening? And then third, honestly speaking, they have to do some sort of forensic analysis of their Amazon accounts receivable.

It’s easier said than done simply because of the volume and how complex it is. But I think, these are the three things that we would recommend vendors to do to make sure that there’s ultimately no leakage happening and impacting their profitability.

Sreenath: Very cool. In terms of your service, can you share with us—at a very high level—how would this work for a vendor?

Rohan: Yeah, sure. Our goal is to really bring visibility and take away this very time-consuming process and automate it. So our platform is really very simple. All we need is access to the vendors central account, and once we have the access, the data is automatically brought into our platform.

We stitch the data together and we run our algorithms onto the data. And then the output really is identifying where these overbilling deductions are happening, where the shortage is happening, and the reason why they’re happening. Once we do that, we’ll present our findings to the vendor. And once the vendor gives us the green light, our team will then index the data, format the data, and work with Amazon FinOps team to dispute those claims and manage that process all the way till the funds are credited back to the vendor’s account.

So that’s kind of the first step. And then the second step is really then saying, hey, you know what? We’ve identified this much over-billing because of XYZ reason. Now let’s talk about how you can avoid that from happening in the future. Yeah. So we manage that product—the entire process start to finish.

[09:46] – Success stories

Sreenath: Can you share a couple of success stories that you’ve had so far?

Rohan: Yeah, absolutely. Like I said, all kinds of different-sized vendors are using the platform. One of the best ones that I’d like to share is we work with an advertising vendor, and we were able to recoup almost half a million dollars for them because there was some duplicate billing happening in one of their agreements. But when you take a look at half a million dollars, by no means, is it a small amount of money. But for a vendor that is in a medium-sized vendor that can mean a lot of money and how those monies are actually used to plow back into the business, whether it’s advertising and promotions. And what have you? And I think maybe we have some sort of Robin Hood syndrome, right.

We’re really excited whether it’s half a million dollars and 50,000 or a million dollars. I think our ability to go find these funds and get those funds recouped for these vendors gives us a special kind of joy.

Sreenath: Yeah. And also in our current environment, any amount of cash you can put back into plate has to be impactful for these vendors.

[10:56] – External cost quotients faced by Amazon vendors

Rohan: Yeah. Today, to your point, the vendors are facing so many external cost quotients. Right. Freight’s up.

Sreenath: CPCs are up.

Rohan: CPCs are up. That’s your world. Raw material is up. I was just talking to—just this morning—a very large toy vendor and resin has gone up significantly and they’re really trying to figure out, hey, you know what? We want to continue to grow our Amazon business. We need to go out and find marketing dollars because our cost has gone up and we’re not getting the same amount of money that they were getting two years ago to spend in advertising.

Sreenath: Yeah, absolutely. Rohan, this is a fascinating conversation for me because, as you know, we don’t spend a ton of time thinking about this function of Amazon. We are immersed in advertising & analytics. The idea that there could be impactful amount of opportunity left on the table. And actually, in this case, literally, money left on the table that could be put back into place—pretty interesting.

[11:57] – Advice & guidance for Amazon vendors

Sreenath: Any guidance or advice for vendors that they should take away from this conversation? Besides all the things you’ve shared already.

Rohan: I think on a quarterly basis, maybe doing a sampling of your invoices and seeing if you’re able to reconcile them, I think is a good practice. And I would say that having that sort of forensic accounting mindset is helpful and I will be kind of very clear. Right. This is not ill in tech, but because so many things are happening in a very complex system, right. Things get lost, mistakes happen. And I think vendors should really kind of keep that in mind and really pay special attention to—if they’re not able to reconcile an invoice or handful of invoices—they should dive deeper into it.

Sreenath: Yeah. So sample the data. I like the phrase forensic accounting mindset.

Rohan: Yeah.

Sreenath: Just to summarize this conversation. Clearly, there’s a great deal of complexity around vendors, the different forms of contracts, also, the different types of scenarios in which there could be discrepancies coming up, the sheer volume of data that has to be analyzed. It sounds like that results in at least a good number of cases, some decent opportunity that you’re focused on discovering for the vendors.

Rohan, this has been great, super insightful for me. And hopefully, anyone that listens to this conversation for anybody that wants to connect with Rohan, here is his contact information about DimeTyd as well as Rohan’s email. Thank you for tuning in. Rohan, we’ll be in touch and wish you the best.

Rohan: Thanks, Sreenath. I appreciate you having me on. Thanks so much.

Sreenath: Take care. Bye.